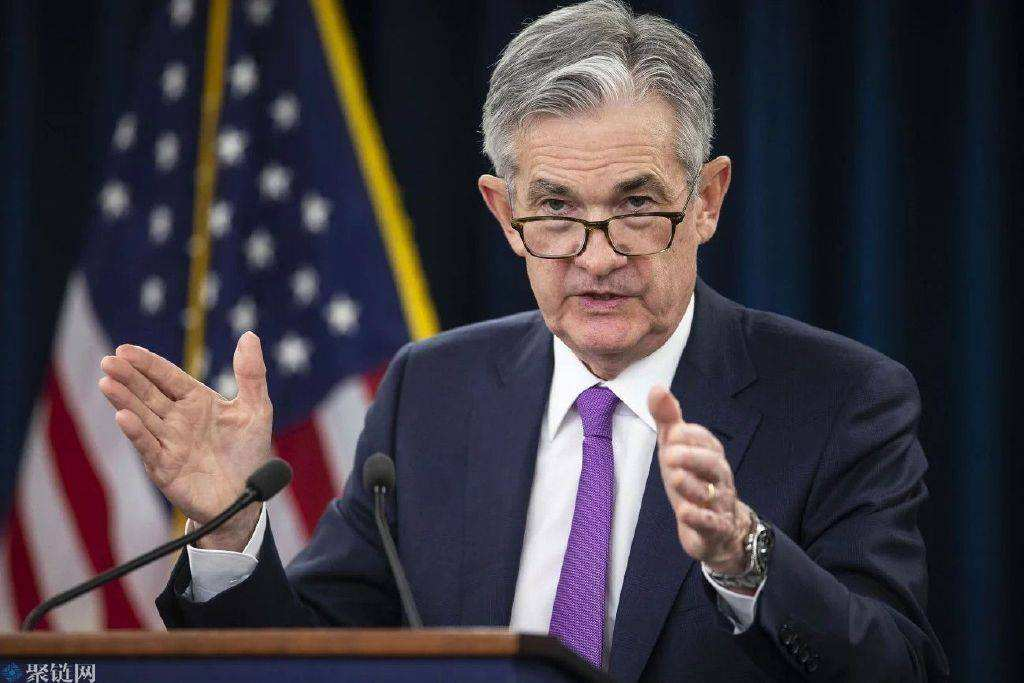

USihlalo we-US Federal Reserve (Fed) uJerome Powell (uJerome Powell) waya kwintetho ebanjwe yiKomiti yezeMali ye-Senate izolo (22) ngokuhlwa ukuze angqine kwingxelo yomgaqo-mali wesiqingatha sonyaka."Bloomberg" wabika ukuba uPowell ubonise kwintlanganiso ukuzimisela kweFed ukunyusa izinga lenzala ngokwaneleyo ukubona ukunyuka kwamaxabiso okubonakalayo kupholile, kwaye wathi kumazwi akhe okuvula: Amagosa e-Fed alindele ukunyuka kwexabiso lenzala eqhubekayo kuya kufaneleka ukukhulula i-40 Uxinzelelo lwexabiso olushushu kakhulu. kwiminyaka.

“Ukunyuka kwamaxabiso kunyuke ngokucacileyo ngokungalindelekanga kulo nyaka uphelileyo, kwaye kusenokubakho izinto ezothusayo ezizayo.Ke kufuneka sibhetyebhetye ngedatha engenayo kunye nokutshintsha kwembonakalo.Isantya sokunyuka kwamaxabiso exesha elizayo siya kuxhomekeka ekubeni (kwaye ngokukhawuleza kangakanani) ukunyuka kwamaxabiso kuqalisa ukuwa, umsebenzi wethu awunakusilela kwaye kufuneka ubuyisele ukunyuka kwamaxabiso kwi-2%.Nakuphi na ukunyuswa kweereyithi akukhutshelwa ngaphandle ukuba kubonakala kuyimfuneko.(100BP ibandakanyiwe)”

I-Federal Reserve (i-Fed) ibhengeze ngomhla we-16 ukuba iya kuphakamisa inzala ngeemitha ze-3 ngexesha, kwaye inzala ye-benchmark yenyuka ukuya kwi-1.5% ukuya kwi-1.75%, ukwanda okukhulu ukususela ngo-1994. Emva kwentlanganiso, yathi Intlanganiso elandelayo kusenokwenzeka ukuba inyuke ngama-50 okanye ngama-75%.indawo yesiseko.Kodwa akukhange kukhankanywe ngokuthe ngqo ubungakanani bokunyuka kwamaxabiso kwixesha elizayo kwindibano yangoLwesithathu.

Ukufika kwindawo ethambileyo kunomngeni kakhulu, ukudodobala koqoqosho yinto enokwenzeka

Isibhambathiso sikaPowell sidale inkxalabo emandla yokuba eli nyathelo lingafaka uqoqosho ekudodobaleni.Kwintlanganiso izolo, waphinda wachaza umbono wakhe wokuba uqoqosho lwase-US lunamandla kakhulu kwaye lunokusingatha ukuqiniswa kwemali kakuhle.

Wachaza ukuba i-Fed ayizami ukucaphukisa, kwaye ayicingi ukuba kufuneka sibangele ukudodobala koqoqosho.Nangona engacingi ukuba amathuba okuhla kwamandla emali aphezulu kakhulu ngoku, uyavuma ukuba kukho ithuba ngokuqinisekileyo, ephawula ukuba iziganeko zamva nje zenze ukuba kube nzima kwi-Fed ukunciphisa ukunyuka kwamaxabiso ngelixa igcina imarike yabasebenzi eyomeleleyo.

“Ukumisa kwindawo ethambileyo yinjongo yethu kwaye izakuba ngumngeni omkhulu.Iziganeko zeenyanga ezimbalwa ezidlulileyo zenze ukuba oku kube nzima ngakumbi, cinga ngemfazwe kunye namaxabiso ezinto zorhwebo kunye nemibandela eyongezelelweyo ngamakhonkco okubonelela. "

Ngokutsho kwe "Reuters", i-Fed i-dovish, kwaye uMongameli weBhanki ye-Federal Reserve yaseChicago uCharles Evans (uCharles Evans) wathi kwintetho ngaloo mini ukuba uhambelana nombono ongundoqo we-Fed wokuqhubeka nokunyusa izinga lenzala ngokukhawuleza ukulwa. ukunyuka kwamaxabiso aphezulu.Kwaye wabonisa ukuba kukho imingcipheko emininzi ephantsi.

"Ukuba imeko yezoqoqosho iyatshintsha, kufuneka sihlale siphaphile kwaye sikulungele ukulungisa isimo somgaqo-nkqubo wethu," watsho."Ukulungiswa kwicala lokubonelela kunokucotha kunokuba bekulindelwe, okanye imfazwe yaseRussia-Ukraine kunye nokuvalwa kwe-COVID-19 yaseTshayina kunokuthoba amaxabiso," utshilo.Uxinzelelo olungakumbi.Ndilindele ukuba ukunyuka kwamaxabiso kuphinde kufuneke kwiinyanga ezizayo ukubuyisela ukunyuka kwamaxabiso kwi-2% ekujoliswe kuyo.Uninzi lwamalungu ekomiti yokubeka isantya se-Fed akholelwa ukuba amazinga kufuneka anyuke aye kwi-3.25 ubuncinane ekupheleni konyaka %-3.5% uluhlu, ukunyuka ukuya kwi-3.8% kunyaka ozayo, imbono yam ifana ngokufanayo. "

Wachaza iintatheli emva kwentlanganiso ukuba ngaphandle kokuba idatha yokunyuka kwamaxabiso iphucula, unokuxhasa enye inqanaba elibukhali leemitha ezintathu ngoJulayi, esithi i-Fed eyona nto iphambili kukunciphisa uxinzelelo lwamaxabiso.

Ukongeza, ekuphenduleni ukuguquguquka okumangalisayo kwimarike ye-cryptocurrency iyonke kwiintsuku zamva nje, uPowell waxelela iCongress ukuba amagosa e-Fed ajonge ngokusondeleyo kwimarike ye-cryptocurrency, ngelixa esongeza ukuba i-Fed ayizange ibone impembelelo enkulu yezoqoqosho ukuza kuthi ga ngoku, kodwa wagxininisa ukuba Indawo ye-cryptocurrency idinga imimiselo engcono.

“Kodwa ndicinga ukuba le ndawo intsha itsha kakhulu ifuna isakhelo esingcono solawulo.Naphi na apho kwenzeka khona umsebenzi ofanayo, kufuneka kubekho ummiselo ofanayo, akunjalo ngoku ngenxa yokuba iimveliso ezininzi zemali zedijithali zifana kakhulu kwiimveliso ezikhoyo kwiinkqubo zebhanki, okanye iimarike zemali, kodwa zilawulwa ngokwahlukileyo.Ngoko kufuneka siyenze loo nto.”

U-Powell walatha kumagosa enkongolo ukuba ukungacaci kwemithetho yenye yeengxaki ezinkulu ezijongene neshishini le-cryptocurrency ngoku.I-US Securities and Exchange Commission (SEC) inegunya phezu kwezibambiso, kwaye iKomishoni yokuRhweba i-Commodity Futures Trading (SEC) inegunya lokulawula iimpahla.Ngubani na kanene onegunya kule nto?I-Fed kufuneka ibe nelizwi malunga nendlela iibhanki ezilawulwa yi-Fed eziphatha ngayo i-crypto assets kwi-balance sheets.

Ngokuphathelele umba osanda kutshatyalaliswa wolawulo lwe-stablecoin, u-Powell wathelekisa i-stablecoins kwiimali zeemarike zemali, kwaye ukholelwa ukuba i-stablecoins ayinayo isicwangciso esifanelekileyo sokulawula.Kodwa kwakhona wancoma intshukumo yobulumko yamalungu amaninzi eCongress ukuba acebise isakhelo esitsha sokulawula i-stablecoins kunye ne-asethi yedijithali.

Ukongeza, ngokutsho kweCoindesk, i-SEC isanda kucetyiswa kwimiyalelo yogcino-mali kwiinkampani ezidwelisiweyo ukuba iinkampani ezigcina iimpahla zedijithali zabathengi kufuneka ziphathe ezi asethi njengeze-balance sheet yenkampani.U-Powell uphinde watyhila kwintlanganiso izolo ukuba i-Fed ivavanya isikhundla se-SEC malunga nokugcinwa kwe-asethi yedijithali.

Ukwandiswa kolawulo lukarhulumente kukwayinto entle kwii-cryptocurrencies, ezivumela ii-cryptocurrencies ukuba zingene kwindawo ethobelayo kunye nenempilo.Inokukhusela ngcono amalungelo kunye nomdla kumashishini anyukayo kunye namazantsi e-cryptocurrencies ezifanaabasebenzi basezimayininabatyali mali virtual.

Ixesha lokuposa: Aug-21-2022